Flash Update - Floating Rate Notes in EUR: Benefiting from the ECB rate hiking cycle

Fixed Income Team - Union Bancaire Privée, UBP SA

Key takeaways - Data as of 9 September 2022 :

- ECB terminal rate: 2.3%-2.5% by March 2023

- Floating Rate Notes enable investors to benefit from rising short-term rates

- UBAM - Dynamic Euro Bond invests in FRNs

- Yield of 2.1% currently and expected return of +6.6% over the next 24 months

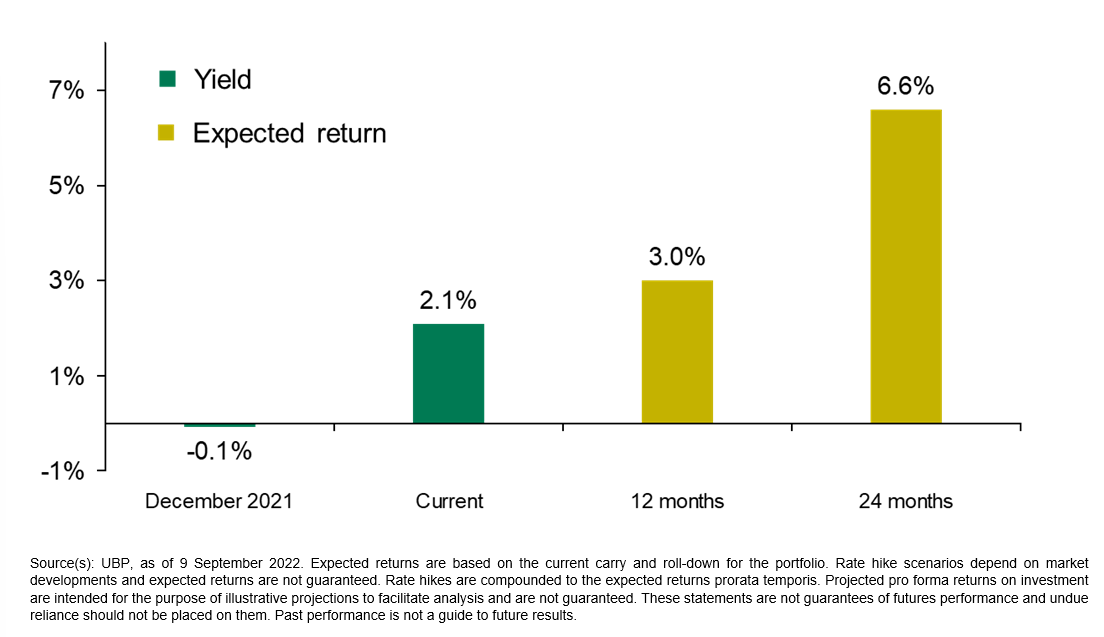

The European Central Bank has just raised its deposit rate to 75 bps from 0 bp with investors expecting more rate hikes as they anticipate a terminal rate up to 2.3%-2.5% by March 2023 as illustrated in Figure 1 below.

An investor looking to benefit from the ECB’s rate-hiking cycle should consider floating-rate notes (FRNs). Firstly, they have no exposure to interest rates – meaning they do not suffer the sort of capital losses normal fixed-coupon bonds do when the interest rate increases – and secondly they gain when short-term rates rise.

Figure 1: ECB’s deposit rate and market expectations for future rate hikes, in %

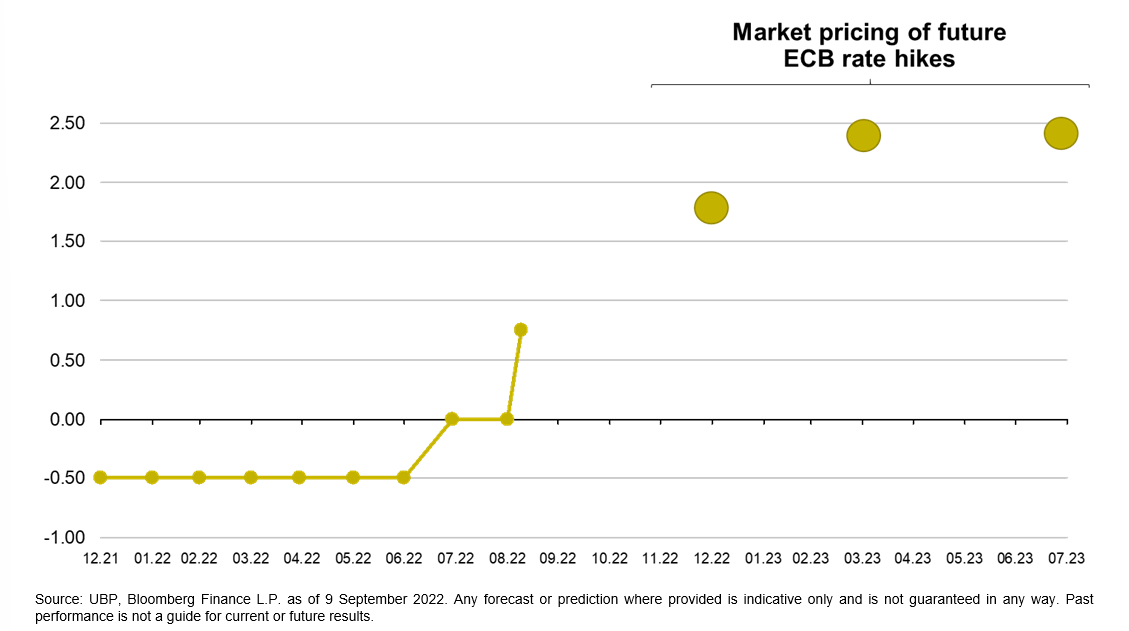

UBAM - Dynamic Euro Bond is a floating-rate portfolio that invests notably in FRNs. It currently has a modified duration of 0.2 years. Its yield was -0.1% at the end of December 2021, and has gradually increased to 2.1% today as the ECB has hiked rates by 125 bps so far this year.

Therefore, based on market forecasts for the ECB’s deposit rate, the strategy’s expected return is +3.0% for the next 12 months and +6.6% for the next 24 months, as illustrated in Figure 2 below.

Figure 2: Current yield and expected returns of the portfolio