COP 27 & COP 15 wish list from UBP's Impact Team

Victoria Leggett, Head of Impact Investing notes: “The big opportunity for COP 27 and COP 15 running so close together is to highlight the interlinked nature of the climate and nature crisis. We have made significant progress with climate, in terms of targets, disclosure and acceptance of what must be done. We are significantly behind with nature and it is only just becoming understood that to reach net zero, we must also develop a nature-positive economy.”

Wishes for COP 27

The end of fossil fuel subsidies

- As the issue of implementation is high on the agenda of COP27, we can hope that the matter of fossil fuel subsidies will be back on the table with, maybe, a timetable for them to be phased out.

Fossil fuel subsidies:

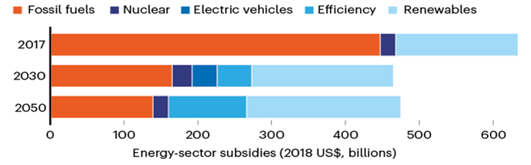

- Were estimated to dwarf renewables subsidies as recently as 2017 (source: Irena)

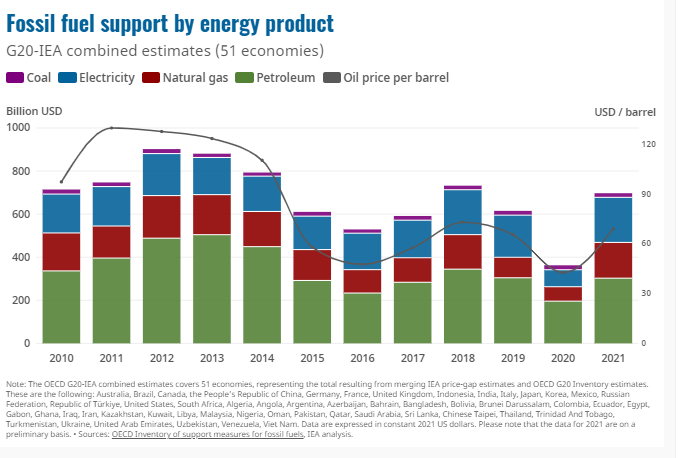

- Have barely gone down if we believe the most recent OECD numbers on the topic:

- As investors in more energy-efficient products and in renewable energy companies, we regret that many of the companies competing with our portfolio companies benefit from public subsidies on fossil-fuels.

- The trend towards more specific sector implementation pledges (as seen in Glasgow with the agreements on coal and methane) could in principle lead to more specific agreements when it comes to subsidies.

- It is arguably not very likely that something significant will happen on that front, but we remain hopeful.

Climate finance: USD 100 billion at last

- The target of raising USD 100 billion per year from developed countries to address climate change is a historic promise that hasn’t been kept and could find a resolution at COP27.

- This wouldn’t be enough anyway as the IMF estimates that low- and middle-income countries will need USD 2.5 trillion of external financing by 2030, but it is a highly symbolic promise that has been a point of frustration for a long time and was already a sticking point at Glasgow.

- We think there is a good probability of success on that front (success meaning a firm commitment to reach USD 100 billion in the very near term).

Global solidarity

- The issue of losses and damages is high on the agenda too. This is not a main area of focus for us as investors, but we recognise that any show of global solidarity on that front is key to mobilising a majority of countries, particularly among the low- and middle-income ones.

- Given that COP27 is presented as “a COP for Africa” and that a country like Pakistan made the headlines this year by suffering the dramatic consequences of the current level of warming, we hope that progress can be made in that area, although we are not too sure of what form it could take.

A global carbon market?

- The negotiations around Article 6 of the Paris climate deal have stalled, which is preventing the creation of a global carbon credit market. We hope for progress on this, but only if it doesn’t come at the expense of the quality of the credits traded, unlike what happened with voluntary carbon-reduction projects: the lack of a proper regulatory framework has led to a lack of credibility among many offsetting schemes, and this in turn makes it difficult to assess the emission-reduction plans of many private actors.

- An agreement on a high-quality global carbon market would therefore be very good news.

Regulating net zero claims

- We see many companies doing their best, and we enthusiastically support the Science-Based Initiative. But we also think that regulation can accelerate the pace of change in that area.

- The decision by the UK to mandate the disclosure of climate plans for all large companies is a step in the right direction, and so is the development of groups that organise commitments at sector level, such as the Net Zero Asset Managers Initiative.

- However, there is much more progress to be made and an expert group has been mandated this year by the United Nations to work on this topic. Hopefully some of its initial conclusions will be discussed at COP27.

Wishes for COP 15

An ambitious Framework

- The Global Agreement on Nature (the Biodiversity Framework), which is to be launched at COP 15, is still being finalised, with many crucial targets being debated. There are 22 targets, divided under 4 goals. They all contribute to the mission to halt and reverse biodiversity loss. Therefore, the more of these targets are agreed upon, without dilution, the better. The most prominent one is target 3: the pledge to protect 30% of land and sea by 2030.

Mandatory disclosure (target 15)

- The acceptance of target 15 would provide a platform for the Taskforce on Nature-related Financial Disclosures (TNFD) to succeed. Disclosure is often the first step towards change, and making nature-related disclosures mandatory for multinational corporations and financial institutions should have a very powerful effect. In 2021 18,600 companies reported climate data through the environmental impact reporting organisation CDP. Only 3,900 reported on nature. It is critically important we close this gap as we can only manage what we can measure.

Fewer harmful subsidies and more commitment to funding

- It is important that participants set a clear agreement on how countries, especially developed countries, should finance the goals that underpin the framework (targets 18 & 19).

Participation by all key – particularly developed – nations

- China will be a strong presence at the high-level COP 15 talks on 15–17 December, even though that session is being held in Montreal. This will be a major opportunity for being bold in setting the next targets.

For more information on UBP’s Impact platform see here:

- UBAM Positive Impact Equity Fund (launched 28/09/2018) – Victoria Leggett, Rupert Welchman

- UBAM Positive Impact Emerging Equity Fund (launched 07/05/2020) – Mathieu Nègre, Eli Koen

- UBAM Biodiversity Restoration Fund (launched 29/09/2021) – Victoria Leggett, Charlie Anniss, Adrien Cambonie

Press contact:

Gunther De Backer

Partner, Backstage Communication